Want to Make Extra Money Now?

|

Have you ever thought about where the money you invest goes and what it supports?

Have you considered making an investment not just for gaining profit but want to see it as an opportunity to make a positive impact through socially responsible investing practices?

If your answers are yes to the questions above you might want to know about Swell Investing.

Swell Investing goal is to invest your money for impactful companies dedicated to making the world a better place and supporting environmental efforts for sustainability.

Read on to find out what sets Swell Investing apart from other Robo Advisers in this Swell Investing Review.

Then you can decide if this is the right Robo Advisor for you.

|

Table of Contents

+

|

About Swell Investing:

|

| Bonus: SavingExpert readers can sign up for free! |

About Swell Investing

Launched in 2016, Swell Investing is an investment company based in Los Angeles and is backed by Pacific Life which is a company with 150 years of financial services experience.

As an impact investing platform, Swell provides an investment option for investors who want to participate in SRI or Sustainable, Responsible and Impact Investing.

It supports companies centered on clean water, disease eradication, healthy living, green technology, renewable energy, and zero waste causes.

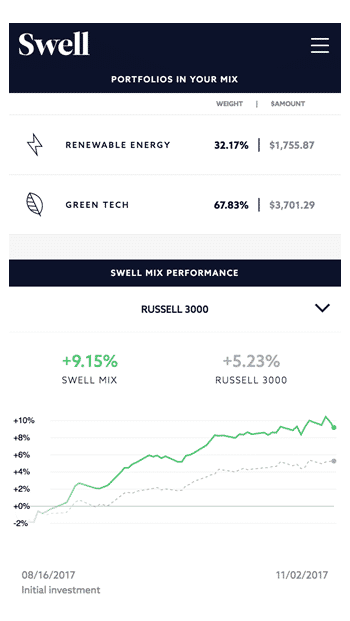

Swell Investing uniquely allows investors to choose the portfolios they want to put their resources in and how much they would want to allocate for each of them.

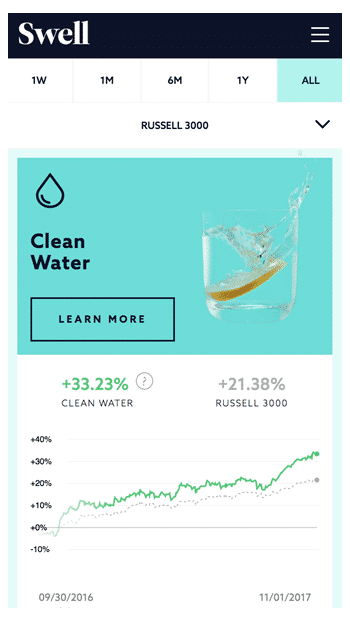

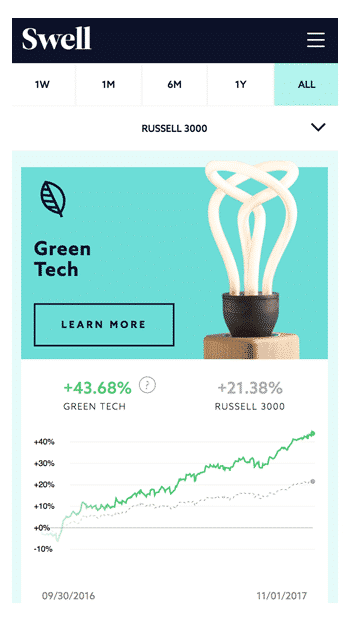

Swell Investing Screenshots

How Does Swell Investing Work?

Swell Investing serves as your investment advisor and lets you select from available portfolios managed by the Swell platform.

You’ll be required to key in relevant information upon signing up. Then you pick for your preferred portfolios and connect your bank account. Once you're a Swell investor, you will own individual stocks rather than ETF’s or mutual funds.

It's never a bad thing to become a socially responsible investor — If you want to add socially responsible investing to your portfolio, Swell could be the way to go.

The all-inclusive fees and minimum account requirement of only $50 make it a very attractive option.

Swell Investing Options

Swell is currently offering six portfolios. These investing options offer unique segment of socially responsible investing and are comprised entirely of stocks and ADRs:

- Green Tech — Focused on energy efficiency, building desirable products and making a concerted effort to reduce the pull on the energy infrastructure. This portfolio is composed of 53 companies, including BorgWarner (BWA), Johnson Controls (JCI), and Tesla Motors (JCI).

- Renewable Energy — Focused on companies that are harnessing natural resources (alternative energy sources) to power the world. In this portfolio, there are 64 companies, including Analog Devices (ADI), TransDigm Group (TDG) and Eaton Corp. (ETN).

- Zero Waste — Focused on companies that provide solutions for composting, recycling and creating new materials from recycled materials. This portfolio is made up of 37 companies, including Steel Dynamics, Inc. (STLD), FLIR Systems, Inc. (FLIR) and Parker-Hannifin Corp. (PH).

- Clean Water — Focused on companies engaged in conserving water, cleaning it up and streamlining systems. This portfolio contains 44 companies, including Albemarle Corp. (ALB), Parker-Hannifin Corp. (PH) and Martin Marietta Materials, Inc. (MLM).

- Healthy Living — Focused on companies engaged in food, fitness and new technologies that enable people to live longer, healthier lives. In this portfolio, there are 54 companies, including Align Technology, Inc. (ALGN), Garmin Ltd. (GRMN) and VF Corp. (VFC).

- Disease Eradication — Focused on pharmaceutical and biotech companies conducting R&D and developing novel approaches to combatting today’s biggest health challenges. This portfolio holds 68 companies, including Abbott Labs (ABT), Becton Dickinson & Co. (BDX), and AbbVie, Inc. (ABBV).

Swell Fees

Swell Investing fees are flat, fair, and inclusive. You will pay 0.75% annually on your balance.

Swell requires an initial minimum account balance of $50.

They won’t penalize you if market performance causes your account to dip below $50, but if you choose to withdraw an amount that will take your account below the minimum, they will ask you to either skip the withdrawal or close your account instead.

If all you ever do is put in your first $50, your annual fees will be approximately $0.37 ($50 x 0.0075= $0.37).

The Good and Bad

Following are the list of the advantages and drawbacks of Swell Investing worth considering.

? What we like about Swell Investing

|

? What we didn't like about Swell Investing

|

Swell Investing Qualifications

To be a qualified Swell investor, you must be 18 years old or above and have a US citizenship or residency status.

Once you sign up, you will be asked for the following information:

- Your name

- Your address

- Your Social Security number

- Your date of birth

- Your citizenship/residency status

- Your email address

- Your employment status

Is Swell Investing Worth It?

If your goal is to invest with a cause and you don’t have huge investment funds available at your disposal, Swell Investing can be one of the best options for you.

It is best for hands-off investors and those who have fewer funds for investment, as Swell provides an investment opportunity for starters with a minimum investment of $50.

You won’t be paying for yearly expense ratios but you’ll have to pay for an annual fee amounting to 0.75% of your investment balance.

But if you are looking to invest in more diversified portfolio Swell may not work well for you.