Is Acorns worth it? With Acorns, you can automatically save & invest your spare change from everyday purchases, earn Found Money with 300+ brands, read custom content to grow your knowledge and put your hard-earned cash into diversified portfolios overseen by experts.

Acorns is a microsavings app similar to Digit and Qapital, but with a kick. This app saves you money but allows you to invest this money with a click of a button.

Your savings can actually make you money, and you can even get started with a $10 bonus through this link.

In this Acorns review, we will answer the question of is Acorns worth it?

[P_REVIEW post_id=581 visual='full']

| Update: Acorns is now offering will $10 sign up bonus for newly opened accounts. After registering, you'll see the $10 balance in your account. |

Acorns at a Glance

What we liked about Acorns

|

What we didn't like about Acorns

|

Best for: If you're a college student you can sign up for Acorns with your .edu email address and use it for free. Or if you an investor who doesn't have time to watch over your portfolio, your money is safe with Acorns (and will bring you positive returns).

The Bottom Line: Acorns is a pretty well laid out platform which helps you save small amounts of money with spare change and small daily investments as low as $5 a day or a week.

What is Acorns?

|

Featured App: Acorns LEARN MORE |

About Acorns:

|

CNBC calls it “the new millennial investing strategy.”

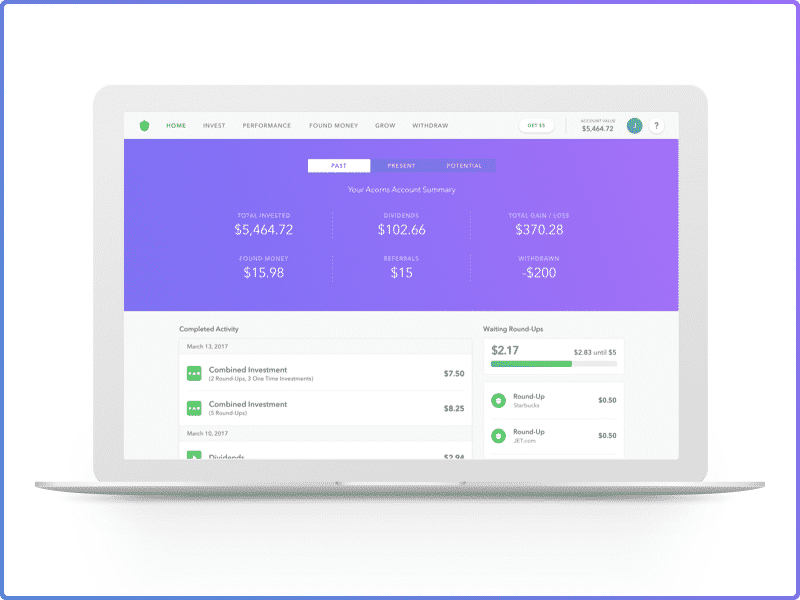

Once you connect the app to a debit or credit card, it rounds up your purchases to the nearest dollar and funnels your digital change into an investment account.

Sign up to try it risk-free with a $10 sign up bonus.

Acorns in Action

Acorns Features

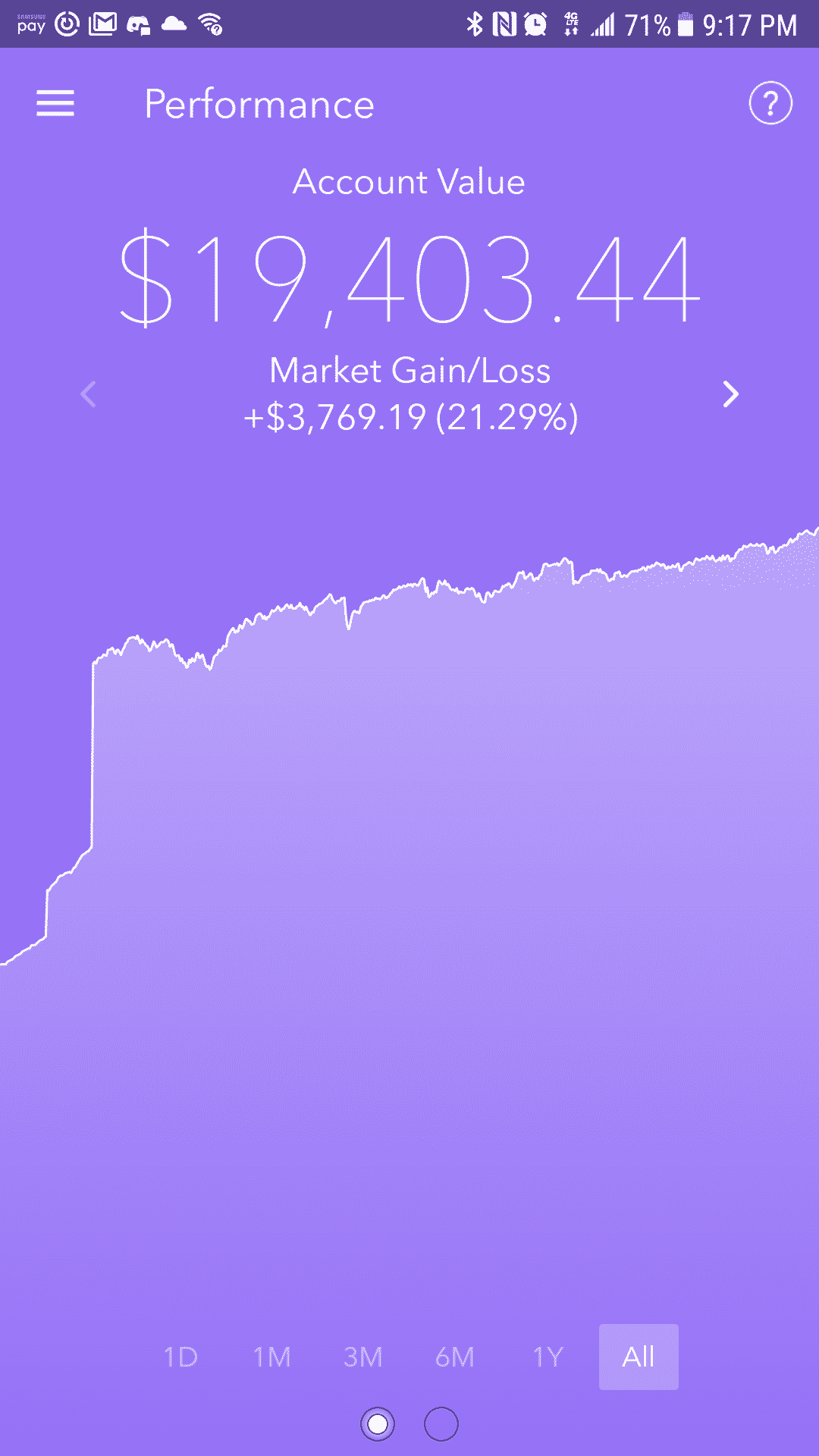

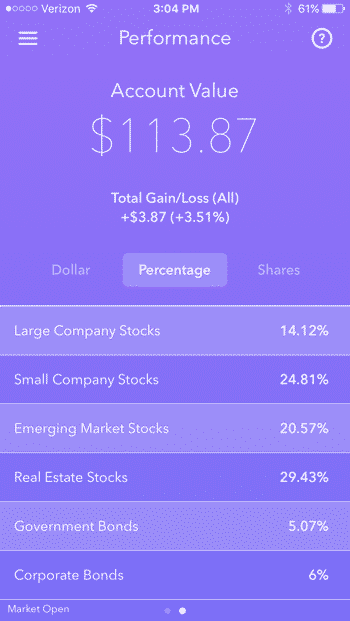

One feature that we love about Acorns is that the money that you're saving is being invested. By investing your spare change, it makes it simple for you to grow wealth over time.

So what's the big deal about investing?

Well, do your coworkers or friends all talk about their investment portfolios? You’ve been meaning to get in the stock game, but how do you start if you don’t have a big wad of cash to invest?

We’ve got your answer. It’s called Acorns, and it’s an app that lets you start investing without risking big bucks.

How Does Acorns Work?

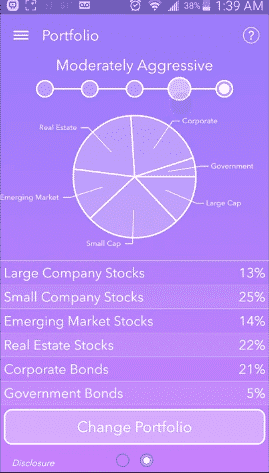

Acorns Core automatically invests your spare change and lets you invest as little as $5 any time or on a recurring basis into a portfolio of ETFs. Your investments are then diversified across more than 7,000 stocks and bonds, and Acorns automatically rebalances your portfolio to stay in its target allocation.

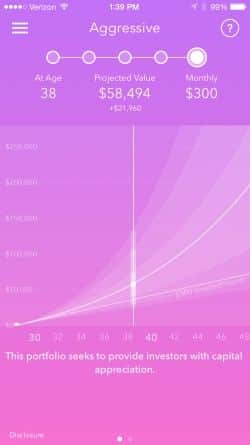

Acorns Later, the IRA account, lets you automatically save for retirement by setting easy Recurring Contributions. When you sign-up, the app recommends the right IRA for you based on your goals, employment and income.

With Acorns Spend, that comes with a checking account and debit card, you can save, invest and earn while you spend. Acorns Spend has no overdrafts or minimum balance fees, plus free or fee-reimbursed ATM access nationwide.

Check out this video for more about how Acorns works.

It's pretty simple and the beautiful app does it for you after a few minutes of setting up the preferences you can:

- Invest automatically: Set aside spare change or extra cash as you go about your day with Round-Ups and Recurring Investments.

- Save for later: Get the easiest IRA, Acorns Later, and save for retirement without thinking about it.

- Stick with it: Sit back and let your money grow over time in diversified portfolios constructed by experts.

- Earn Found Money: The more you earn, the more you can save and invest! Grow faster the 250+ top brands that invest in you when you shop.

- Grow your knowledge: Original content right in your app helps you grow your money knowledge on the go.

- Spend Smarter (New): Pre-order the only checking account with a debit card that saves and invests for you, plus no minimum balance or overdraft fees. Qapital has this feature which we go over in our Qapital review, but you aren't able to earn interest or invest on your savings accumulated. This is where Acorns shines.

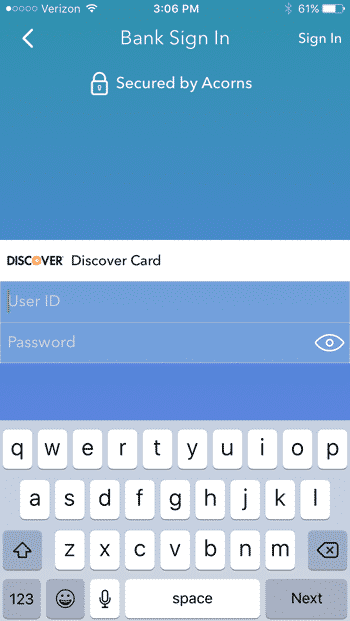

How Does Acorns Protect Your Information?

All of your data is protected with 256-bit encryption and never stored on your phone, tablet or computer.

You can learn about Acorn's security measures here.

Acorns Fees and Pricing

Simple pricing: Acorns starts at $3 per month. No surprise fees, just surprise upgrades. For more, check out the pricing page.

Acorns Personal: $3/month

| Summary: Acorns automatically invests your spare change and lets you invest as little as $5 any time or on a recurring basis into a portfolio of ETFs |

Get a lot for a little with the original micro investing app at $1/month. Here are some of the features you can get:

- Automated Investing: Invest the Change® from everyday purchases, set it and forget it with a Recurring Investment, and keep growing from reinvested dividends

- Smart Portfolios: Constructed with help from a Nobel Prize winning economist to automatically rebalance when the market moves

- Grow Magazine: The best money advice you never got

- Found Money: 200+ top brands invest in you when you shop

Acorns Later

| Summary: Acorns Later is the easiest way to save for retirement. |

Still wondering if Acorns is worth it? With Later, you can set up an Acorns Later account in just a few taps. They will also help you with the following:

- Your IRA: Acorns will recommend an IRA and portfolio that’s right for you

- Automatic Updates: As you approach retirement, your investments automatically shift to align with your goals

- Recurring Contributions: Set an automatic Recurring Contribution

- Anytime, Anywhere: Set aside extra cash for a better life later — as little as $5 can add up

- Assisted Rollovers: If you have an IRA or 401k now, our support team will help you roll over to Acorns Later

More Features

You may be ready to answer your question of, “is Acorns worth it?” by learning about the $3/month plan which includes:

- Instantly Save & Invest: Real-Time Round-Ups, automatic retirement savings, custom Spend Strategies and more…

- Ease & Access: Digital direct deposit, mobile check deposit and check sending, free bank-to-bank transfers, unlimited free or fee-reimbursed ATMs nationwide and more…

- Earn More Money: All the Found Money that comes with Acorns, plus up to 10% invested in you from places you visit every day

- Spend Strategies: Easy, smart ways to save together while you spend

- A Lot for a Little: No overdraft or minimum balance fees and unlimited free or fee-reimbursed ATMs nationwide — with an investment account and a retirement account built in

- Grow Your Knowledge: From quick tips to original content, grow your money knowledge as you go

- Total Protection: FDIC-protected all the way to $250,000, plus fraud protection, all-digital card lock and 256-bit data encryption

Acorns Alternatives

If you don't think Acorns is worth it, you can check out apps like Acorns and alternatives.

8/10 Qapital Review |

SavingExpert Rating: SavingExpert Rating:8.6/10 Digit Review |

9/10 Acorns Review |

| OPEN ACCOUNT | OPEN ACCOUNT |

OPEN ACCOUNT |

| Devices iOS App, Android App |

Devices iOS App, Apple Watch, Android App, SMS |

Devices iOS App, Apple Watch, Android App |

| Promotion $10 Sign up Bonus |

Promotion $5 Sign up Bonus |

Promotion $5 Sign up Bonus |

| COMPARE THE MICROSAVINGS SERVICES |

Is Acorns Worth It?

To conclude our Acorns review, we are left with the following question: Is Acorns worth it?

If you're a college student you can sign up for Acorns with your .edu email address and use it for free. Or if you an investor who doesn't have time to watch over your portfolio, you're money is safe with Acorns (and will bring you positive returns).

Overall, Acorns is a pretty well laid out investing app that helps you save small amounts of money with spare change and small daily investments as low as $5 a day or a week.

Imagine if you could invest in your future without really noticing it. Sign up in under 5 minutes and join over 4,000,000 people who thought Acorns was worth it.