Want to Make Extra Money Now?

|

A cash advance allows you to use your credit card to get a short-term cash loan at a bank or ATM when you need money now. Cash advance online serves as an instant fix to emergency cash needs without a prior formal loan negotiation process or any collaterals.

These short termed loans are typically offered for smaller sums that need to be remitted back in a stipulated time of two to three weeks. Creditors charge all the non-differentiated borrowers a funding fee on the total borrowed sum that can range from 15 to 20%.

Cash advances can make sense for emergencies when one needs money immediately. However, this convenience comes with a fee in the form of interest rates as suggested earlier. So we'll review cash advance aspects you should know about before shopping around for a cash advance online or with the traditional brick and mortar way.

What is a cash advance?

A cash advance is a short-term cash loan — an expensive one — taken against the credit line on your credit card. In general terms, a cash advance is thought as a credit card where you pay for, let’s say, the electricity bill or the groceries by drawing cash from that credit card and paying it back in a stipulated time frame later.

Also, cash advances are something similar to a refund anticipation loan or a few of you might think of it as an overdraft facility provided by banks because banks provide you with money that you are required to pay back. Actually, a cash advance loan is also a payday loan as you, in fact, get some advance cash that you need to pay back in the next paycheck cycle.

Whatever the case, the bottom line is you get money in advance that must be repaid fairly quickly and with associated fees.

How (and why) do you get a cash advance?

Like we discussed above, two major types of cash advance loans provide you with quick cash and differ slightly in terms of working, ease of qualifying and interest rates. Let us see how they differ depending on the type of cash advance loan.

Cash advance on your credit card. Borrowers must have a valid credit card to draw quick cash if they wish to opt for this method, otherwise, it might involve extra time to apply and seek approval for a loan. Credit card holders can usually visit the nearest ATM, use a valid PIN and get the cash they need instantly.

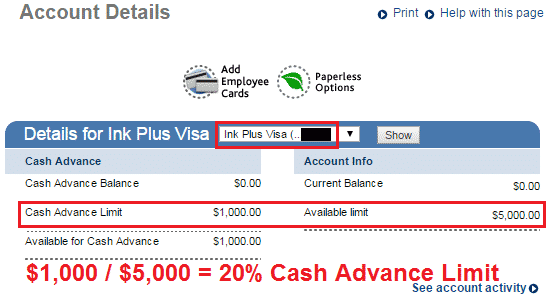

Users can call the credit card company customer services at banks like Chase or request a cash advance online. Also, they can keep track of cash advances through credit card statements. This may all sound quick and easy but there’s a catch, these types of advances are charged at a comparatively higher interest rate and secondly, cash advances can be available only up to a certain predefined cash advance limit depending on the card holder’s credit score.

Cash advances in the form of a payday loan. One can approach a local payday loan lender or a more beneficial option is to search for a payday loan lender online. In both cases, the borrower needs to submit his bank and identity information including the employer details. Providing a credit score or undergoing a credit check is not required. On approval, the borrower has sanctioned a short termed loan for one to two weeks. They are also required to write a post-dated check or grant permission to the debit bank account number they hold in the bank. The payment/check would be equal to the amount of the borrowed money with the addition of a funding fee or interest amount. The main benefit of using online services is that the borrower gets cash instantly transferred to their bank account within a few hours depending on how soon the approval happens.

What one needs to know about cash advances online?

Simple and streamlined online approval processes like the ones for cash advances involve just three steps and the entire process can be completed 100% online much faster when compared to applying for credit cards through a bank. The process is as follows:

- Provide the name, address, phone number, email, checking account information, proof of income and/or employment details.

- Usually, the final decision is completed within minutes and on your approval, you will be redirected to an e-signature page that displays information such as the loan amount, interest rate, minimum payment, and length of the loan.

- Accept the terms of the loan and get the funds deposited directly into your checking account.

Why cash advances are expensive

Given the costs associated with taking a cash advance, you should take it as a sign that you're in dire financial straits if you're considering one. You should consider the below aspects:

Expensive Option. No doubt one can get quick cash even with bad credit using this option however the interest rates can be higher than the much slower loan methods like a personal loan from Prosper and other lenders. Applying online through a financial help website provides you options to search for a suitable lender.

Fine Prints Matter. Legal jargons involved in terms and conditions seem irritating but need to be handled with a fine tooth combing. Thus, always opt for websites that provide fine prints written in a simple and easy to understand language with all kind of assistance needed in understanding the fine print. Most importantly, always proactively read out the terms and conditions before signing.

Watch out for Financial Traps. Not all financial lending websites want to help needy borrowers. Websites may involve complicated web designs that make users select the default loan amount that may be at a higher end or maybe not what they intend to borrow for. Don’t forget to look out for the original loan amount on the application forms as your vigilance is the only protection from predatory lending financial traps!